When she’s not writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

What is the Contribution Margin Ratio?

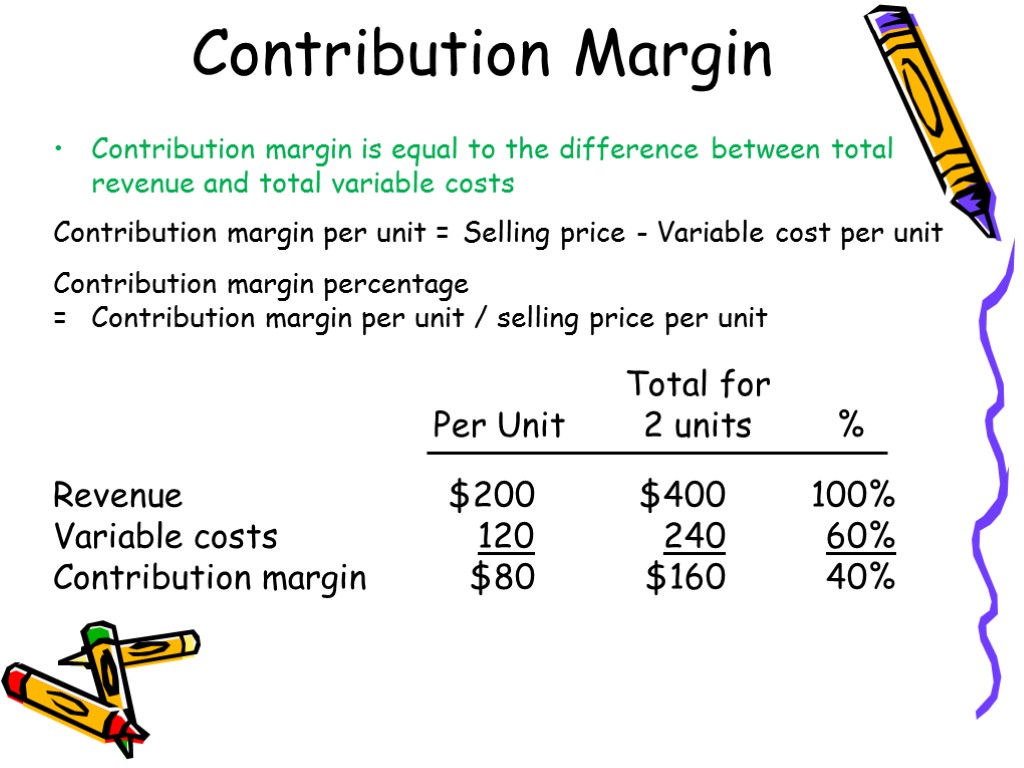

This is because the contribution margin ratio indicates the extent to which your business can cover its fixed costs. Yes, the Contribution Margin Ratio is a useful measure of profitability as it indicates how much each sale contributes to covering fixed costs and producing profits. A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs.

Contribution Margin vs. Gross Profit Margin

It means there’s more money for covering fixed costs and contributing to profit. Cost accountants, FP&A analysts, and the company’s management team should use the contribution margin formula. CM is used to measure product profitability, set selling prices, decide whether to introduce a new product, discontinue selling a product, or accept potential customer orders with non-standard pricing. Break even point (BEP) refers to the activity level at which total revenue equals total cost. Contribution margin is the variable expenses plus some part of fixed costs which is covered. Thus, CM is the variable expense plus profit which will incur if any activity takes place over and above BEP.

Contribution Margin: Definition, Overview, and How To Calculate

In other words, your contribution margin increases with the sale of each of your products. Let us understand the step-by-step process of how to calculate using a unit contribution margin calculator through the points below. This is because fee-for-service hospitals have a positive contribution margin for almost all elective cases mostly due to a large percentage of OR costs being fixed. For USA hospitals not on a fixed annual budget, contribution margin per OR hour averages one to two thousand USD per OR hour.

Fixed cost vs. variable cost

- This demonstrates that, for every Cardinal model they sell, they will have $60 to contribute toward covering fixed costs and, if there is any left, toward profit.

- That is, this ratio calculates the percentage of the contribution margin compared to your company’s net sales.

- Direct materials are often typical variable costs, because you normally use more direct materials when you produce more items.

However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price. The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources. Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice 5 ways debt can make you money to produce only one of them. Now, divide the total contribution margin by the number of units sold. Instead of doing contribution margin analyses on whole product lines, it is also helpful to find out just how much every unit sold is bringing into the business. Calculating the contribution margin for each product is one solution to business and accounting problems arising from not doing enough financial analysis.

Formula

At a contribution margin ratio of 80%, approximately $0.80 of each sales dollar generated by the sale of a Blue Jay Model is available to cover fixed expenses and contribute to profit. The contribution margin ratio for the birdbath implies that, for every $1 generated by the sale of a Blue Jay Model, they have $0.80 that contributes to fixed costs and profit. Thus, 20% of each sales dollar represents the variable cost of the item and 80% of the sales dollar is margin.

In the same example, CMR per unit is $100-$40/$100, which is equal to 0.60 or 60%. So, 60% of your revenue is available to cover your fixed costs and contribute to profit. The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good.

An important point to be noted here is that fixed costs are not considered while evaluating the contribution margin per unit. As a result, there will be a negative contribution to the contribution margin per unit from the fixed costs component. A surgical suite can schedule itself efficiently but fail to have a positive contribution margin if many surgeons are slow, use too many instruments or expensive implants, etc. The contribution margin per hour of OR time is the hospital revenue generated by a surgical case, less all the hospitalization variable labor and supply costs. Variable costs, such as implants, vary directly with the volume of cases performed.